If you are an academic (9-month) employee and will be returning to UW employment in the fall of 2016, or you are an academic (9-month) employee with a summer appointment, you will have additional insurance premiums deducted from your April 1, April 29 and/or June 1 paychecks to continue your insurance coverage through the summer months. These additional insurance premiums, taken along with your regular monthly insurance deductions, are referred to as ‘summer prepay deductions.’

You must be expected to return for the fall semester, or you must continue employment in a summer service/summer session appointment to have insurance coverage continue during the summer contract break. Insurance premiums cannot be taken from summer service or summer session appointment earnings. If an employee is working Summer Session(s) or Summer Service, the insurance premium deductions will have to be taken prior to this appointment via summer prepay deductions, or must be paid through direct payment by the employee.

If your anticipated fall 2016 employment status changes after you have already had additional insurance premiums deducted, you may receive refunds for these additional deductions. If you will be terminating employment, and you will not be returning in the fall, contact your Benefits office immediately. They will assist you in determining your employment termination date and the date your insurance coverage will end.

If you anticipate that you will experience any other status change; marriage, adoption, divorce, etc., please contact your Benefits office immediately so you are informed about the impacts to your insurance benefits.

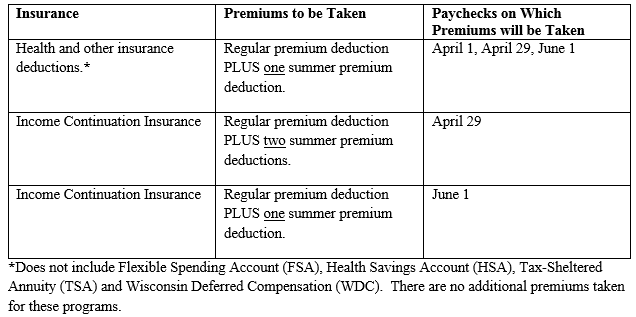

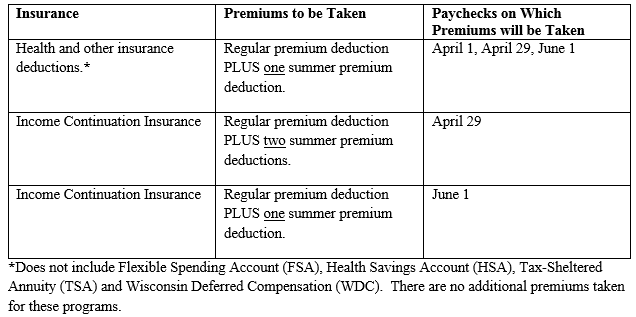

IMPORTANT: The chart below illustrates insurance premiums deducted for an employee scheduled to return to UW employment in the fall of 2016, or who has a summer appointment and is then terminating. Most employees will have deductions taken according to the chart below. Your Benefits office will determine your specific appointment, any summer employment, your fall return date, or your end date, and if your deduction schedule will vary from the schedule below.

2016 Summer Prepay Deduction Schedule

How Summer Prepay Deductions Appear on Your Earnings Statement

Summer prepay deductions will appear as a lump sum amount on earnings statements. All deductions taken pre-tax (most medical-related premiums and a portion of State Group Life premiums) will be added together under the name ‘Prebtx’ and all deductions taken post-tax (most life insurance premiums) will be added together under the name ‘Preatx.’

Regular benefit deductions for the month will continue to be listed under the plan name. These deductions are typically taken on a pre-tax basis. If you have one extra deduction for each plan, there will be a total listed under Prebtx on each earnings statement impacted by the additional deductions. NOTE: ‘Prebtx’ stands for before tax or pre-tax and ‘Preatx’ stands for after tax or post-tax.

IMPORTANT: To verify accuracy, please review your earnings statements to ensure that your insurance deductions are accurate for your situation. If insurance premiums are not collected through the summer prepay deductions process, you will be billed for premiums. In this case, you must remit timely premium payments to continue your insurance coverage.

If you have questions, please contact the Benefits office at payrollandbenefits@uwgb.edu.