Sixteen UW-Green Bay employees learned how to crush the six motivators responsible for sugar cravings during the July 9th Lunch ‘n Learn presented by Celeste Faye.

Sixteen UW-Green Bay employees learned how to crush the six motivators responsible for sugar cravings during the July 9th Lunch ‘n Learn presented by Celeste Faye.

On April 1, 2015, the Department of Employee Trust Funds (ETF) authorized the release of new, lower-cost inflation protection options for the Mutual of Omaha, MutualCare Custom Solution long-term care insurance policy. This policy is available to employees, annuitants and their family members. (Spouse, domestic partner, parents and in-laws are all eligible to apply, even if you don’t purchase.)

Each year, many Americans lose significant income, savings and assets because of long-term care expenses. Your group’s long-term care insurance is designed to help protect against the high costs of long-term care if you or a family member can no longer perform activities of daily living without the need of assistance. Health insurance or Medicare will not pay for this type of care. For many, long-term care insurance is an important part of planning for their long-term financial security.

The MutualCare Custom Solution policy offers some very unique built-in benefits that include:

HealthChoice also provides CareOptions services to all State, University of Wisconsin and UW Hospitals & Clinics Employees, Annuitants and their family members at no charge. CareOptions can assist you and your family with issues related to wellness, illness, disability or aging. Additionally, CareOptions can help you and your families create Living Wills (advance directives for healthcare) as well as allow you to conduct healthcare provider searches, provider background checks, medical information research and long-term care planning, 24 hours a day.

To receive a complete information packet regarding your long-term care insurance options and access to the new CareOptions resources, simply click here to request an information packet. You may also call HealthChoice toll-free at 1-800-833-5823 or in the Madison area at 833-5823 or email info@healthchoice.com. Direct information link; click or paste in your web browser’s address line: http://www.healthchoice.com/reply1

HealthChoice has worked with the Department of Employee Trust Funds (ETF) since 1995 providing excellent service and the highest quality long-term care insurance plans to State, University of Wisconsin and UW Hospitals & Clinics Employees, Annuitants and their family members.

CareOptions® is registered trademarks of NavGate Technologies®, a division of CareQuest® Inc. The CareOptions system is owned and operated by NavGate Technologies and provided by HealthChoice Insurance Solutions as a service to its group members at no cost. CareOptions is a consumer driven wellness and care planning system – CareOptions is not insurance nor is it owned or operated by any insurance company, HMO or care provider.

This insurance plan has been authorized by the Group Insurance Board for the purpose of offering long term care insurance to eligible State of Wisconsin employees and retirees under authority granted by Wis. Stats. § 40.55. The criteria the Board uses include, but are not limited to: documentation of financial stability, demonstration of a reasonable ratio of claims paid to the premium level, authority to conduct business in the State of Wisconsin, agreeing to conditions for the rate-making process and other administrative conditions. ETF staff and the Board’s actuary review proposals for participation prior to Board approval. However, the Board does not require competitive bids or a benefit comparison with similar products from other vendors. Authorization for payroll deduction should not be construed as an endorsement of this plan by either the Group Insurance Board or the Department of Employee Trust Funds. This insurance has exceptions, limitations and reductions. This letter is used as a source of leads in the solicitation of insurance and you may be contacted by an insurance agent.

Insurance products are offered through HealthChoice. HealthChoice is not affiliated with any insurance company or HMO. Long-Term Care Insurance is underwritten by Mutual of Omaha Life Insurance Company, Omaha, Nebraska 68175.

Policy form ICC13-LTC13

ICC13-M28385-WIAG

583 D’Onofrio Drive 101 • Madison, Wisconsin 53719 • (800) 833-5823 • Fax (608) 833-7540 E-mail: info@healthchoice.com • www.healthchoice.com

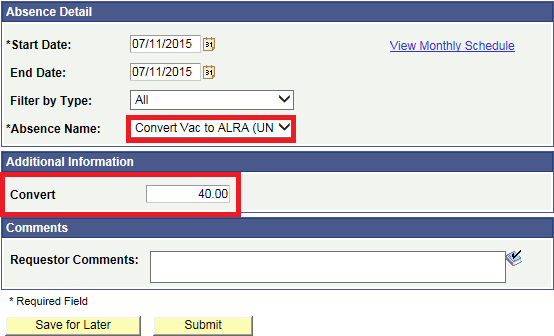

Academic Staff and Limited employees who have completed ten years of qualifying service as of 6/30/2014 have the option to bank unused vacation up to 40 hours. Those who have completed 25 years of qualifying service as of 6/30/2014 can bank unused vacation up to 80 hours. The unused vacation hours are taken from the 2013-14 FY balance first, then from the 2014-15 FY, until the elected or maximum hours are reached (pro-rated for part-time employees).

New this year, the ALRA election will be submitted through Employee Self Service on the My UW System Portal, similar to entering leave.

To submit your ALRA election, you will need to complete the following steps:

ALRA designations should be entered through the Request Absence screen by 8/5/15.

Want to get in on the fastest growing sport in America?

UWGB Director of Marketing Sue Bodilly shares her favorite pastime – Pickleball – in this Lunch and Learn session.

Sue will be joined by a few members of the Packerland Pickleball Players club who will guide you through the game, its rules, a few strategic pointers, and then allow YOU to get in on the action. Come and see why the sport (a combination of ping-pong, tennis and badminton) is booming from coast-to-coast, and right here in Green Bay.

All equipment is provided.

When: Thursday, July 16, 2015; 12:00 – 1:00 p.m.

Where: Student Services Plaza

Please RSVP by Tuesday, July 14, 2015 to Sue at bodillys@uwgb.edu

Rain Date is Thursday, July 23, 2015

Live Webinars Scheduled for July

ETF is offering a series of 30-minute, live, interactive webinars designed to increase your understanding of Wisconsin Retirement System benefits. Individuals can also ask questions at the end of these sessions.

Beneficiary Designations Do you have a beneficiary designation on file with ETF and does it reflect how you’d want your WRS death benefits paid? This webinar reviews the importance of having a beneficiary designation on file and keeping it updated as life events occur. We’ll also review the process of how to correctly complete a designation form, what it means if you do not have one on file with ETF, and how to request a copy of your current form.

WRS Employer and Employee Contribution Rates This webinar will review how employer and employee contributions help keep the WRS fully funded. We will discuss how the contribution rates are calculated, why they change annually, where those dollars go and the contribution rate changes for 2015.

Overview of the Wisconsin Retirement System This webinar will cover participation in the WRS, vesting requirements, how the WRS is funded and benefits available under the WRS. Also included is a brief overview of the Core and Variable Trust Funds and how the WRS is structured.

5 Basic Steps to Your Retirement Consider this webinar your quick reference guide to starting the retirement process within the next 12 months. We’ll review: choosing a termination date, how to request a retirement estimate – and how to read and understand it. We’ll also cover how to schedule a retirement appointment and – drum roll here — how to submit the retirement application

Please contact Human Resources at (920) 465-2390 or payrollandbenefits@uwgb.edu with any questions.