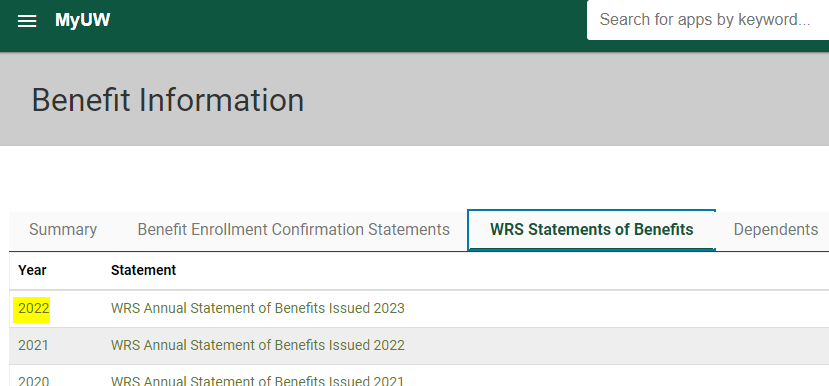

Employees covered by the Wisconsin Retirement System (WRS) can now view their WRS Statement of Benefits as of January 1, 2023, in the My UW portal. To view your statement, launch the Benefit Information tile and click on the WRS Statements of Benefits tab.

Your WRS Statement of Benefits includes 2022 earnings and service, retirement benefit projections (if vested), separation benefit, death benefit, and employee and employer contributions.

Resources

- Introductory letter

- Explanation of Annual Statement of Benefits

- UW System WRS Statement of Benefits web page

- Webinar: Understanding Your Annual WRS Statement of Benefits (registration required)

Beneficiary Reminder

It is recommended that you review the beneficiaries listed on your WRS Statement of Benefits and if a beneficiary is not listed complete a Beneficiary Designation Form.

Death benefits are paid according to the most recent beneficiary designation form on file with the Department of Employee Trust Funds (ETF) prior to your death. Your beneficiary does not automatically change due to a life event, such as divorce or marriage.

To add, change, or remove beneficiaries, complete one of the following forms and mail the completed form to ETF at the address listed on the form.

- Beneficiary Designation Form (ET-2320): Allows you to name primary and secondary beneficiaries.

- Beneficiary Designation (alternate) Form (ET-2321): Allows you to name primary and secondary beneficiaries and/or successors to those beneficiaries.

If you do not have a beneficiary designation on file, death benefits will be paid according to the statutory standard sequence in effect on the date of death.

Questions

If you have questions about your statement after reviewing available resources, please reach out to the UW-System Benefits Counseling team at benefits@uwss.wisconsin.edu or 888-298-0141.

Source: UW System Human Resources