ETF (Department of Employee Trust Funds) is offering a series of short, live, interactive webinars designed to increase your understanding of Wisconsin Retirement System benefits. Individuals can also ask questions at the end of these sessions. To avoid connectivity issues during webinars, we highly recommend using Google Chrome as your web browser.

How to Use ETF’s Online Retirement Calculator

Curious about how much money you’ll get during retirement? Our most used online tool, the retirement calculator, lets you see how much money you may get in the future.

By the end of this presentation, you will be able to:

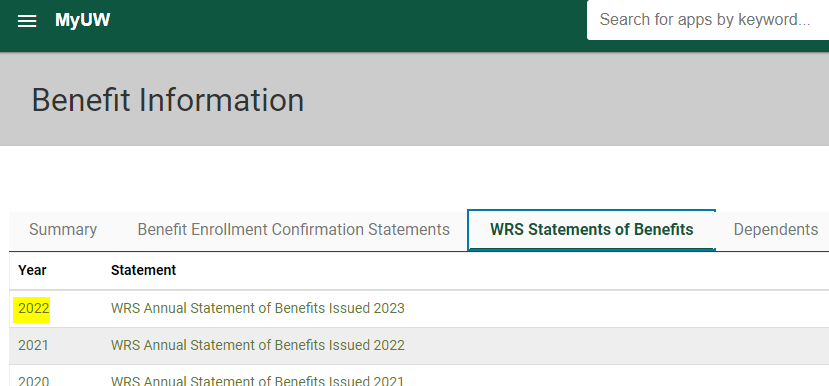

- Find information on your Statement of Benefits used for calculations

- Enter information into the WRS Retirement Benefits Calculator

- See an unofficial estimate of your WRS Retirement Benefits online

- Wed, April 3, 2024 1:00 pm

- Tues, April 9, 2024 6:00 pm

- Tues, April 30, 2024 11:00 am

To register, go to: Events | ETF (wi.gov)

Preparing for Your Retirement

Planning to retire in the next 5 years? Then this webinar is for you. Learn about your WRS benefits and the retirement process.

By the end of this webinar, you will be able to:

- Explain how the WRS retirement benefit works

- Recognize eligibility and prepare to apply for benefits

- Identify the different types of annuity options

- Prepare for health and life insurance changes in retirement

- Find additional resources

- Thu, Mar 14, 2024 11:00 am – 12:00 pm

- Wed, Mar 27, 2024 6:00 pm – 7:00 pm

- Thur, April 11, 2024 1:00 pm

To register, go to: https://register.gotowebinar.com/rt/7817059707818435598

Understanding Your Annual WRS Statement of Benefits

Your annual Statement of Benefits shows you the current state of your WRS account. Not sure about something on your statement? Watch this webinar with your statement in hand. We’ll walk you through each section.

By the end of this presentation, you will be able to:

- Explain the purpose of the Statement of Benefits (ET-7365)

- Analyze the sections of your Statement of Benefits

- Interpret your retirement benefit calculations

- Find resources for more information

- Thur, April 18, 2024 11:00 am

- Tues, April 23, 2024 6:00 pm

- Wed, May 1, 2024 1:00pm

To register, go to: Events | ETF (wi.gov)

WRS Retirement Benefit Calculations

Have you requested a retirement estimate? Thinking about it? In this presentation we’ll discuss how we calculate your retirement benefit.

By the end of this webinar, you will be able to:

- Explain the individual components of the two retirement benefit calculation methods.

- Describe what affects your WRS retirement benefit for each type of calculation (money purchase and formula)..

- Tue, Mar 12, 2024 11:00 am – 11:30 am

- Thu, Mar 21, 2024 1:00 pm – 1:30 pm

To register, go to: https://register.gotowebinar.com/rt/1367036437589766490

WRS Effective Rates and Annuity Adjustments

Each year you may see changes to the amount of your retirement payment. We’ll discuss why and how these changes happen.

By the end of this webinar, you will be able to:

- Define WRS effective rate and annuity adjustment.

- Explain how the Core Trust Fund and Variable Trust Fund effective rates are calculated.

- Explain how the Core Trust Fund and Variable Trust Fund annuity adjustments are calculated.

- Tue, Mar 12, 2024 6:00 pm – 6:30 pm

- Thu, Mar 28, 2024 11:00 am – 11:30 am

To register, go to: https://register.gotowebinar.com/rt/2816230146393650271

WRS Benefits: For New and Mid-Career Employees

Are you a new employee or someone who still has at least 5 years to go before you can retire? It’s never too early to start planning for a secure retirement. Learn how to maximize your WRS benefits.

By the end of this webinar, you will be able to:

- Appreciate the benefits of the Wisconsin Retirement System.

- Designate a beneficiary or several beneficiaries.

- Join or cancel the Variable Fund.

- Use additional contributions to supplement your savings for retirement.

- Wed, Mar 20, 2024 6:00 pm – 6:30 pm

- Tue, Mar 26, 2024 1:00 pm – 1:30 pm

To register, go to: https://register.gotowebinar.com/rt/1015359842469001308