The deadline to bank unused vacation is soon. Twelve-month Faculty, Academic Staff and Limited Appointees (FAASLI) are eligible to bank unused vacation after they have completed 10 fiscal years (July 1 through June 30) of employment. The option to bank unused vacation is a way to save vacation for future use. Banked leave eligibility is viewable effective July 1, with entry required by September 30.

Twelve-month FAASLI are allocated vacation on a fiscal year basis. While they can carry unused vacation into the following fiscal year, the vacation must be used by the end of that fiscal year, or it will be lost. Due to the COVID-19 pandemic, there is currently an Interim Policy which allows an exception to the carryover rule.

UW System Administrative Policy 1200-Interim 08 Extended Vacation Carryover allows leave eligible employees to extend the deadline of unused vacation carryover from June 30, 2021 to October 9, 2021. This extension applies to vacation hours granted July 1, 2018 and carried over an additional year under the one-time exception. It also applies to vacation hours granted on July 1, 2019.

How Much Vacation Can I Bank?

Twelve-month FAASLI are eligible to bank up to 40 hours of vacation per fiscal year after completing 10 fiscal years of employment, and up to 80 hours of vacation per fiscal year after completing 25 years of employment. The amount of vacation that can be banked is prorated for part-time employees. There is no limit to the total number of hours (balance) that can be retained in Banked Leave and the hours do not expire.

As of June 30, 2021, any remaining vacation or vacation carryover up to the allowable amount is eligible to convert to banked leave. HRS will convert the vacation carryover first then convert the remaining vacation.

When Can I Use my Banked Leave?

With your supervisor’s approval, you may use the Banked Leave Balance at any time, and it can be used in any circumstance in which you are allowed to use paid leave.

What If I Terminate Employment?

If you terminate employment any unused banked leave will be paid to you at your wage rate at termination.

To View Eligible Banked Leave Hours

If you have a Banked Leave balance, you may view your balance:

-

- Log in to the My UW Portal.

- Launch the Time and Absence app and click on the Leave Balances tab.

To Bank Leave Hours

To Review the Vacation Policies

UW System Administrative Policy 1210 (formerly BN1) Vacation

Interim Policy

UW System Administrative Policy 1200-Interim 08 Extended Vacation Carryover

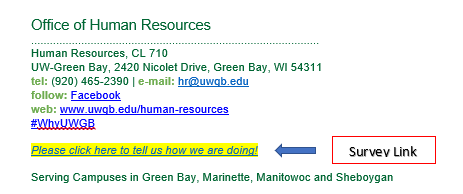

If you have questions, please contact payrollandbenefits@uwgb.edu.

Source: UW System Human Resources and UW-Shared Services, Service Operations